10 fintech trends for 2024 that define the industry’s future

New trends are emerging in the fintech industry from both consumers and the marketplace at large. Find out what’s shaping the industry and gain data-driven insights you can use.

Fintech trends for 2024

The fintech industry has gone through periods of tremendous growth followed by trying times, but new trends are emerging that will define fintech’s course for years to come. These trends are based on research and data from various sources around the fintech world and are meant to help fintech builders and service providers in the space gain insights they can use.

Here are 10 fintech trends fintech companies should consider when planning budgets or launching new products.

1. Consumers will use more fintech apps than ever

After fintech’s pandemic-fueled mass adoption took hold in 2020-2021, fintech apps became a staple of everyday life. This growth has continued in recent years, with 55% of consumers reporting that fintech apps are helping them weather economic challenges. As a result, fintech users are downloading more apps to manage their money and guide financial decisions.

This increasing reliance is shaping consumer banking expectations—as more expect to be able to easily connect their bank accounts to the fintech apps they rely on every day. Today the average fintech user has 3-4 apps and expect to see the number of fintech apps consumers use continue to rise.

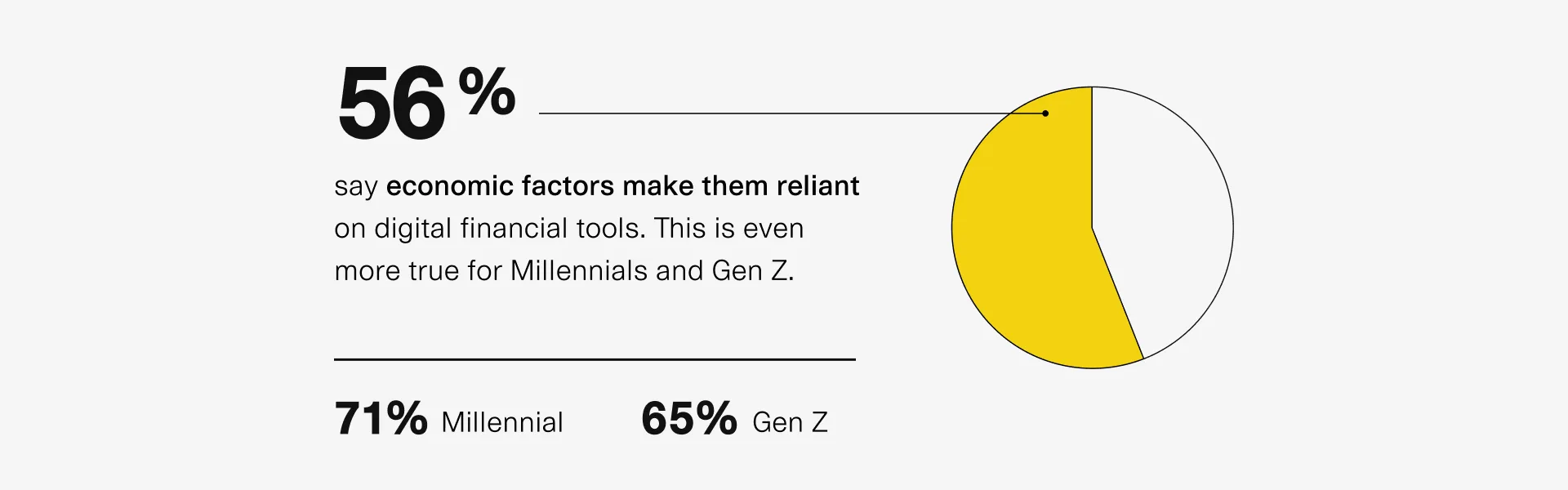

2. Fintech increasingly provides financial stability during uncertain times

The economic downturn of 2022 saw people gravitate to fintech apps to better deal with financial instability and economic uncertainty. 56% said economic factors make them more reliant on digital financial tools to manage their finances.

Going forward, consumers will continue to be concerned about their economic circumstances and will increasingly turn to fintech apps to help them get a better grip on their finances—cementing fintech’s role as a supporter of financial health during tumultuous times.

3. Emerging payment technologies will become as normalized as the credit card

Newer payment types are quickly becoming normalized. It’s expected that nearly 178 million US mobile phone users will make peer-to-peer (P2P) bank account payments in 2025. The release of FedNow, a real-time payment rail from the Federal Reserve, is now providing more consumer choices for real-time bank-to-bank payments. According to Plaid’s Fintech Spotlight report, the compound annual growth rate (CAGR) for real-time payments is expected to increase to 33% by 2032.

Interested in seeing what a modern pay-by-bank experience would look like with Plaid? Watch the video below.

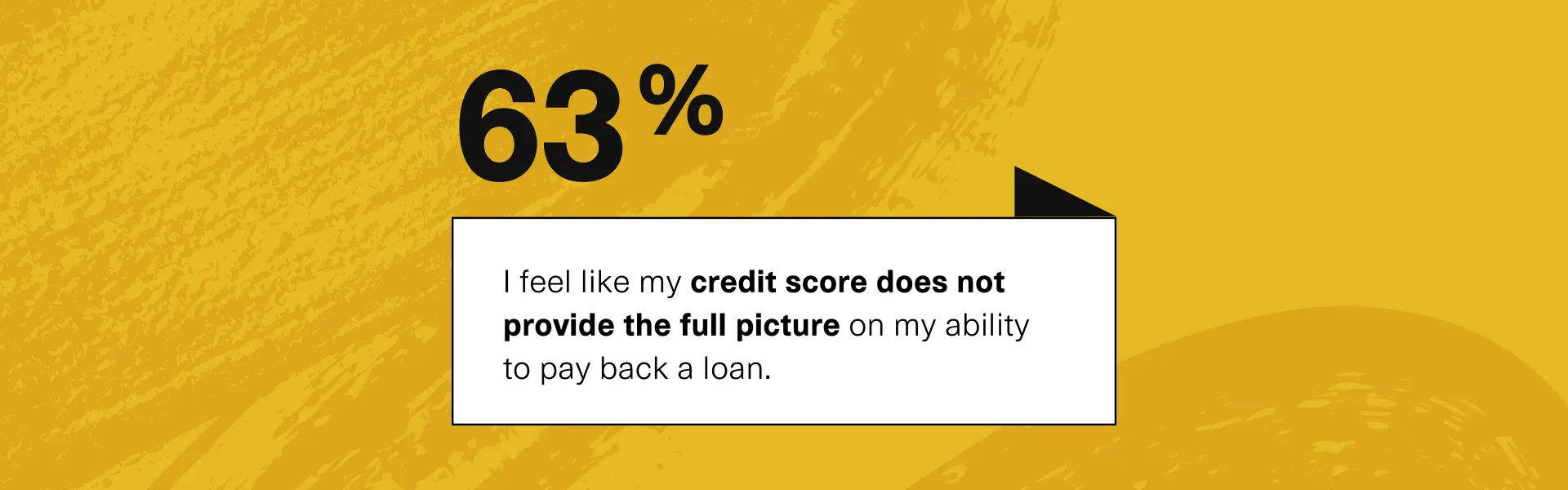

4. Credit score alternatives will revolutionize consumer credit

Lack of a traditional credit score excludes an estimated 49 million Americans from gaining access to loans; and, in some cases, housing and employment. This includes recent immigrants, young people, and the underbanked. In addition, 63% of Americans say credit scores aren’t enough to understand their full financial picture.

New methods of determining credit use alternative data to credit scores—such as cash flow data, pay stubs, and utility bills—to paint a more complete picture of a borrower’s finances.

API-based fintech tools enable lenders to instantly connect to data sources that provide this alternative data, enabling faster and more informed loan decisions. This expands their customer base and helps improve financial access for millions of Americans.

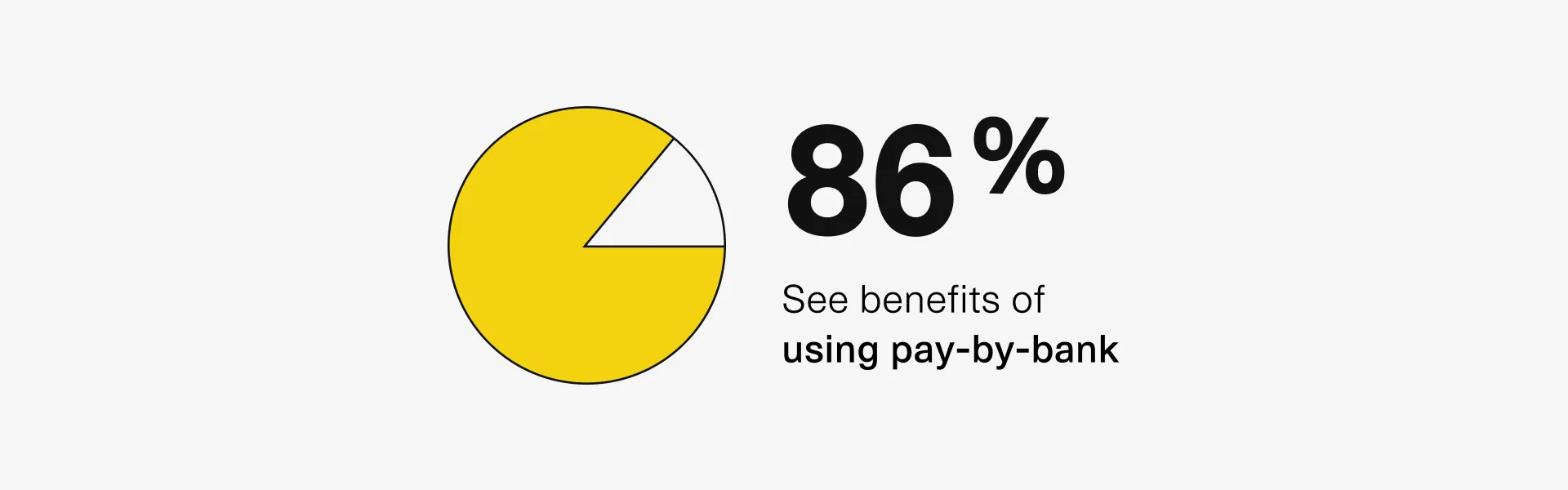

5. Bank payment usage will continue to grow

Pay-by-bank is gaining momentum in the U.S. Plaid helped power more than two billion bank payments in 2023 – double the volume from the previous year. Two-thirds (67%) of consumers are open to pay-by-bank, even when credit and debit cards are an option (openness increases to 72% for fintech users and 74% for Millennials).

The number of instant bank payment rails is also increasing. The value of transactions processed using instant payment rails, such as FedNow and RTP (Real-Time Payments), is expected to grow by 289% between 2023 and 2030. The launch of FedNow in 2023 is likely to continue driving growth for instant payment rails, with more than 400 different financial institutions currently participating in FedNow.

6. Mint shutdown drives new innovation in personal financial management.

The shutdown of the popular budgeting app Mint opened a large gap in the market, which is likely to drive other fintech apps to innovate to capture that market. This may include newer apps or a shift from personal financial management apps to personal financial enablement (PFE) apps, which offer a wider range of services such as robo-advising for investments, online mortgage lending, and other financial services.

7. Financial identity fraud attempts will grow, but identity verification solutions are stepping up to fight it

Synthetic identity fraud—done by combining real identifying information with fraudulent information—has become the top concern of fraud executives and consumers alike. As the quality of deep fake tech continues to increase, the financial services industry will have to fight hard to stay ahead of synthetic identities. However, robust technologies are coming out to combat these attempts.

For example, Plaid Identity Verification uses a sophisticated network to quickly verify identity using selfie verification and more than 16,000 identity data sources. Plaid Beacon, an anti-fraud network, allows organizations to share information about identities that have been associated with fraud. The battle between scammers, especially with the rise of deep fakes, and identity verification systems will continue for years to come.

Plaid’s 2023 Fintech Effect Survey

Navigate the latest consumer trends, create lifetime customers, and grow your businessFirst nameLast nameCompany emailCompany namePhone number (optional)CountryDownload the report

8. Loan volumes begin to trickle back up.

Skyrocketing credit card debt and the reinstatement of student loans will likely drive more users to borrow money to consolidate debt and make everyday purchases. As interest rates stabilize, borrowers are likely to return to the market for loans. Personal loans and buy-now-pay-later loans will likely show the most rapid rebound.

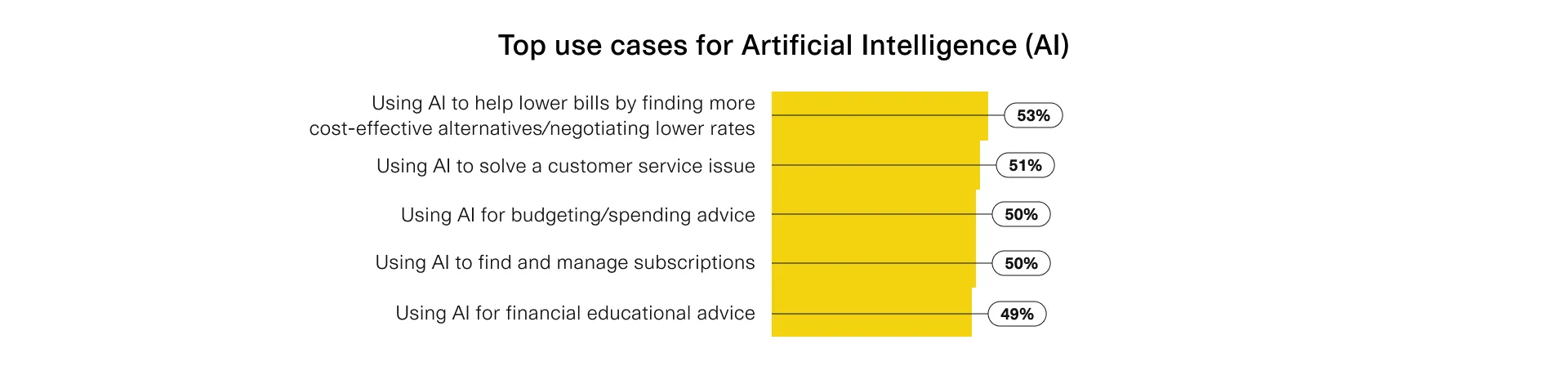

9. AI will revolutionize the way consumers manage money.

Artificial intelligence usage is on the rise, with 55% of respondents to a McKinsey survey saying their organization has adopted AI. While usage remains lower among those we surveyed, expectations are high, with 60% thinking AI will revolutionize the fintech industry in the next five years.

Consumers are looking forward to AI helping them cut bill spending, negotiate lower rates, and provide budgeting advice. Fintech companies look for ways to leverage AI to provide faster service and expand their offerings.

10. Consumers lean into traditional investing as crypto interest cools

Nearly half of all consumers say they are actively engaged in or planning to start trading stocks in the next year, while 42% of Americans say they plan to use high-yield savings accounts and mutual funds. Interest in real estate investing is also on the rise, though many consumers believe it is out of their reach.

Interest in crypto, however, is growing more slowly, with 6 in 10 consumers saying they don’t see it as a sound investment in today’s current economic climate. Despite cooling sentiments around crypto for the average investor, it retains a competitive edge due to the low entry point and the development of more secure crypto onramps.

Fintech trends are all about putting consumers first

The real driving force behind all of the industry-defining fintech trends is consumers. Fintech has grown to where it is today because of its focus on serving consumers in ways that they had never been served before. These trends represent shifting consumer preferences and fintech’s ability to change to meet their needs.

The best way for fintech companies to stay relevant and find room for growth is to be flexible to meet new consumer needs and to stay on top of the trends that consumers drive.

Mon - Fri ( 9:00 am - 5:00 pm )

Mon - Fri ( 9:00 am - 5:00 pm )  +971 52 5200 232

+971 52 5200 232  hello@consiliumadvisory.me

hello@consiliumadvisory.me  https://www.linkedin.com/company/consilium-advisory/mycompany/?viewAsMember=true

https://www.linkedin.com/company/consilium-advisory/mycompany/?viewAsMember=true